I know I wrote an article saying Riocan REIT (TSE:REI.UN) is a sub-par REIT being paraded as a godly company, but for some reason, I bought REI.UN today. I’m going to try to make sense out of it, more for me than you, really, but I guess it might help me come to term with my decision.

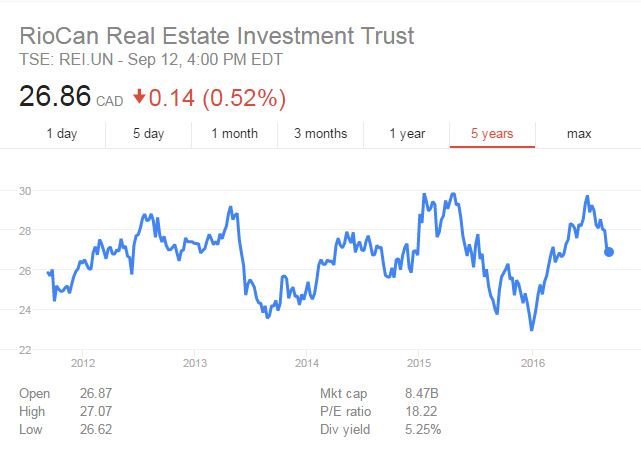

REI.UN is not a bad REIT, but it’s nothing to get excited about. I can think of at least 10 REITs that I would buy before it (BEI.UN, CUF.UN, BTB.UN, TNT.UN, HR.UN, INO.UN, NWH.UN, AX.UN, SRT.UN, APR.UN, to name a few, all on the TSE). I mean, just look at this mess:

In the last five years, the stock hasn’t moved. The only return you’d have gotten would be a measly 5.25% dividend and I cannot think of the last time it was increased. Compare that to some high growth REITs like IIP.UN or even MST.UN:

… and you have a recipe for disappointment. REI.UN doesn’t even have the benefit of a high-dividend, like DRG.UN, SOT.UN and so many others. It doesn’t have the yearly dividend increases like SRT.UN and PLZ.UN neither.

Even amongst large-cap REIT, REI.UN is in my humble opinion completely beaten by HR.UN, REF.UN and BEI.UN, to name a few, who all offer either higher yield, higher growth opportunities or better dividend growth. Oh, and the payout ratio sits at 89.9%, which is okay-ish at best.

So, when it comes to Riocan REIT, what are you left with? Very little, to be blunt.

It is true that the REIT sector underperformed in the last 5 years, for reasons that I honestly do not know. Yes, oil crashed, but this in no way justifies the very mediocre performance of even the REIT index (which covers all of Canada, including provinces with very little oil exposure) since 2011:

11% return in the last five years, woo-hoo!

With that in mind, why the hell did I buy REI.UN today? Well, in simple words:

I believe it’s “due”

Riocan is the biggest REIT in Canada. It can’t always suck. It’s been five years now where they did absolutely nothing, at least in terms of stock prices. At a point or another, things have to chance; yesterday’s losers are tomorrow’s winners, they say.

Is RioCan underpriced when I look at it today? No it is not, but it is not overly overvalued neither. At this point, it’s been underperforming for so long it’s bound to do something eventually. And being the largest REIT in Canada, I don’t think it’s a bad bet at all.

You don’t become the biggest in your field for no reason. I’ve been watching this one for a while and I personally believe now is a great time to invest in canadian REITs. Most of them sell at a bargain, i.e. a discount to their Net Asset Value. Riocan is a premium-name REIT (with high-quality tenants and locations, all very well diversified) being treated and valued as a very average REIT and I don’t think it’s fair. I think I want to believe in its management. And with a 37.7% debt ratio, I think Riocan can benefit from acquisitions in this market.

There is more, of course, but I am pretty glad I bought this company today. Would I rather be holding BTB.UN and its 9.1% dividend instead? Perhaps, yes, but I already have a lot in BTB.UN. I think REI.UN fits well into my 10+ years holding horizon.

Disclaimer: Long 500 REI.UN.

You added the stock “your portfolio can’t go without”!

Stockholm Syndrome?

Why buy a REIT when interest rates are going up? It should cause the sector to go down. Not even counting the recent Canadian real estate news that basically said Vancouver peaked and Toronto is next.

http://globalnews.ca/news/2943992/goodbye-vancouver-foreign-buyers-now-flooding-seattle-and-toronto-real-estate-markets/

They won’t be going up very much when a point or two will double the Feds’ interest costs to finance their wild spending and the spectre of the 1985 era budget crisis returns. They are stuck.

I hedge my REIT holding distributions with MIC holdings, who’s payouts rise behind the prime rate with a year or so lag.

I do own some MIC as well. Great little company.

However, to call it a hedge against rising interest rates is pushing it a bit. IMHO canadian interest rate will rise perhaps once in 2017. Not too scared of that and it’s well priced in. Plus, higher interest rates are nowhere near as bad for REITs as some people pretend it is. Higher rates typically translates to higher rents.

Good point. The thing about REITs in 2008 is the recovered back toward NAV fairly w\ quickly.

What is your position on private REITs? I know the League fiasco has tainted them but League was an obvious ponzi scheme from the get go. I am interested in having a portion of my real estate portfolio in private real estate, being ok with money that will be left alone long term anyway.

I’ve been doing a lot of research on Centurion and Skyline. Centurion seems to be the top pick for me, solid people on its board of trustees, very low debt, and I like their business strategy. Skyline seems pretty solid aside from their slap on the wrist for selling units illegally early on.

Both are putting out 7 points.

I don’t trade private stocks. I was offered many years ago to invest into shop.ca at a significantly low price, and almost did, but I declined. TLDR of it: with private companies, you know when you put your money in, but you never know when you’ll pull it out.

I’ve owned this for long enough that I have to buy new shares each year because my original capital has been returned.

Look at a long term chart. A great investment!!

I think that’s what made me buy it. Honestly, it’s wayyyy past due a rise and I think it will increase by a fair bit shortly.