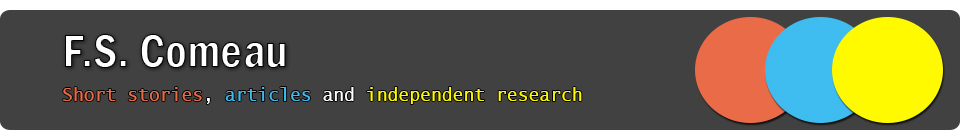

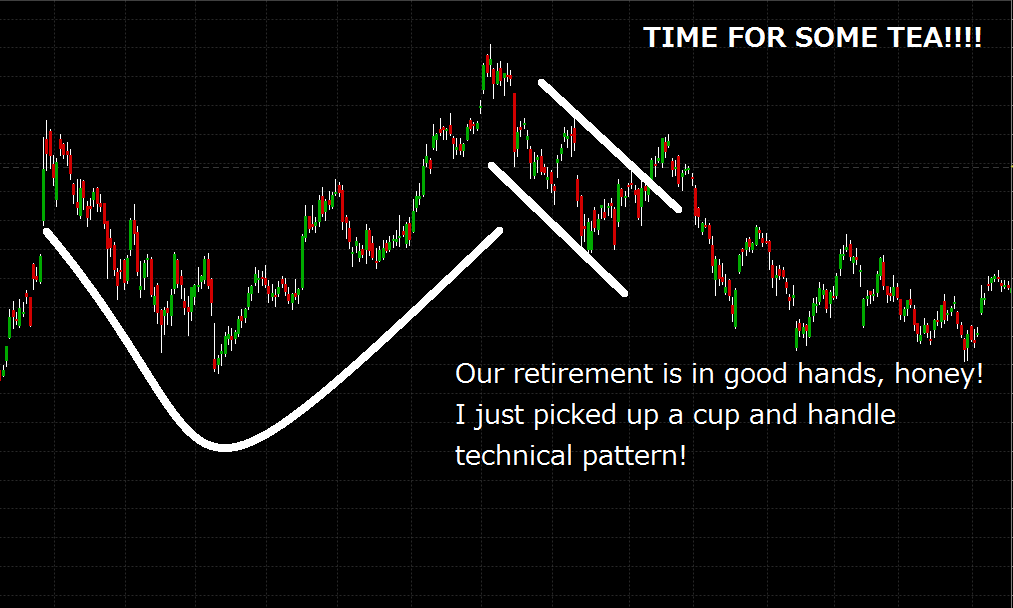

Before I go on, let me explain what “technical analysis” is for me. Technical analysis is the art of looking at this graph and thinking:

“THIS ONE IS GOING UP TO SKY, BABY!!!”

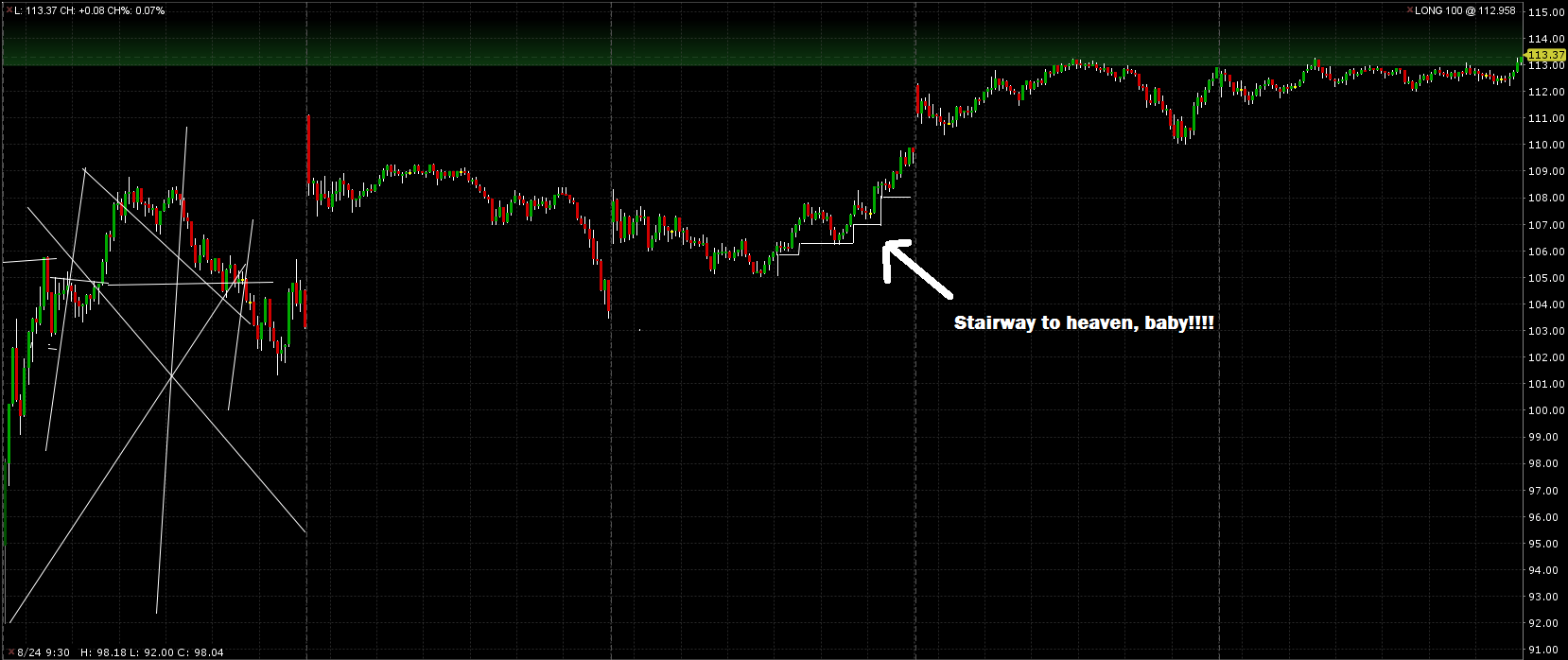

Or looking at this:

And thinking, “THE MARKET IS GOING TO CRASH.”

I like how they added “analysis” to “technical analysis” as if it had some kind of validity

Hey, there’s fundamental analysis, then there’s technical analysis, so both are equally valuable, right? Just two form of “analysis,” two ways to see the market.

Hint: hell no. Technical analysis has ZERO scientific value. It’s exactly the same as someone playing a slots machine and thinking, “I’ve gotten a 7 on the left side six times in a row, now I’m due for a jackpot any second now.” It’s the same as playing roulette and thinking, “This roulette has returned seven red in a row, it’s due for a black anytime now!” or “this roulette has returned 22 red out of 30 spins, it clearly is defective and gives out more red than black! Therefore, I should bet on red!”

IT’S BULLSHIT!

It’s pure pseudo-science, guys. It has ZERO scientific validity. It’s something that was pulled out of thin air and promoted by “gurus” in an attempt to give it credibility. You know all those quacks selling crystals to cure cancer or pretending that there are vibrations that put you in harmony with the universe? Technical analysts are the Wall Street version of those guys, albeit maybe a little less dangerous (maybe).

If you don’t know what technical analysis is (good on you), it’s basically the most annoying thing to ever walk on this planet. It’s not my most hated thing because, let’s face it, there are a lot of things worse than that (illnesses, wars, genocides, hunger, Hilary Clinton) but it always irks me a little to read what I think is a good article and read at the end something like “the 200-day moving average also indicates the stock might be climbing back from its heights blah blah blah.” Immediately, I know I have to forget everything I just read and throw the article to the trash. In a way, perhaps I should be happy technical analysis exists, because it tells me exactly which authors to avoid.

Every analyst who actively promotes Technical Analysis as a way to earn a return higher than the market on a risk-adjusted basis is a moron. TA has never worked and never will. If you seriously think you can look at a chart and guess in which direction the product is moving with any degree of certainty higher than the average, you are wrong.

Do you honestly think beating the market is that simple?

If it was this easy, everyone would do it. Period

Technical Analysis is the kind of thing you can learn in an hour. There’s nothing even slightly complicated or advanced about. When the most complicated mathematics about it is

RSI=100-100/(1+RS)

where

RS = Average gain / Average Loss (on 14 period because, well, because)

RSI = nothing at all

you know you have a problem. Hint: that’s not a complicated mathematical formula.

Unless you’ve worked at a proprietary firm, you have NO IDEA of what you’re going against!

A single proprietary trading firm can have enough computers to fill your house ten times and then some. Each of these computers can easily be $50,000 or more. These firms have zero problem hiring the best programmers in the world for $500 per hour or more to program some of the most complicated programs that ever existed. I’m telling you that people trading at proprietary firms are at least as smart as NASA engineers and sometimes smarter. Except for a tiny number of individuals devoted to making this world a truly better place, in this world, money is a much more powerful motivator than the pursuit of scientific progress. Don’t believe me? A NASA engineer earns something like $100,000 per year. A good trader can EASILY earn $100,000 per DAY. EASILY.

In my career, I saw a data center used for trading that was so large I couldn’t see the back wall. “We haven’t even used most of the computers you see here,” said the guy to me. The firm had been operating been for more than ten years. That gives you an idea of how just well-equipped and well-capitalized these guys is.

These guys have no problem investing millions to cut their ping from 2s to 1.99s. They have no problems paying an additional $10,000,000 per month rent just to have a office that is half a mile closing to Wall Street just so their orders will pass through a milli-second faster. These people have no problems offering a $500,000 signing bonus to grab the best financial engineering grads and then offering millions of dollars in bonuses every year, even if the trader doesn’t perform all that well.

These people can test BILLIONS of possible technical analysis indicators and combinations on about every single product that exists a million times by the time you notice your little “A heads and shoulder pattern is forming!” These people can send a million trade by the time your finger hits the “buy” button. These people can backtest millions of strategies in real time by the time you blink your eyes. And despite all that, the vast majority of these funds do not beat the market on a risk-adjusted basis over an extended period of time.

Do you really think your stupid moving average crap can compete with them?

If you do, go get interned somewhere, because you are basically insane. If you ever listen to a “technical analyst” on TV (you haven’t needed a professional title to be considered a pro for a long time, but now, apparently you don’t even need to understand the market at all) and have any reaction other than laughing at him, trading is simply not for you.

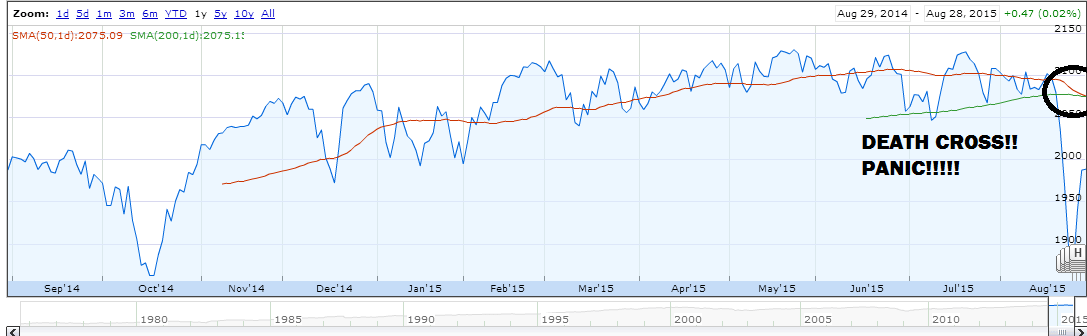

Technical Analysis is to Trading what Astrology is to Science

Many years ago, some great men looked at the sky and thought to themselves: ” I see an Aquarius! I see a Taurus! I see a Sagittarius!” Now, look at that and tell me what you see here:

You mean you don’t see the cancer? It’s obvious man:

It’s the most obvious thing in the world. I remember seeing those five stars and thinking, “Man, this sure looks like a giant crab. Look at the star at the bottom, it looks like it’s a pincer, and the two close-up stars are exactly like eyes!”

Now, look at this:

What do you see in the graph above? To me, it’s more than obvious. It looks like this:

I mean, isn’t it obvious? This chart basically looks exactly like the emoticon above. Look:

I mean, isn’t it obvious?!?!?!?! And if you look carefully, the shrugging emoticon is sloped to the right, meaning a crash is about to happen:

I can’t believe you guys missed it. I mean, it’s obvious. It was basically like printing free money.

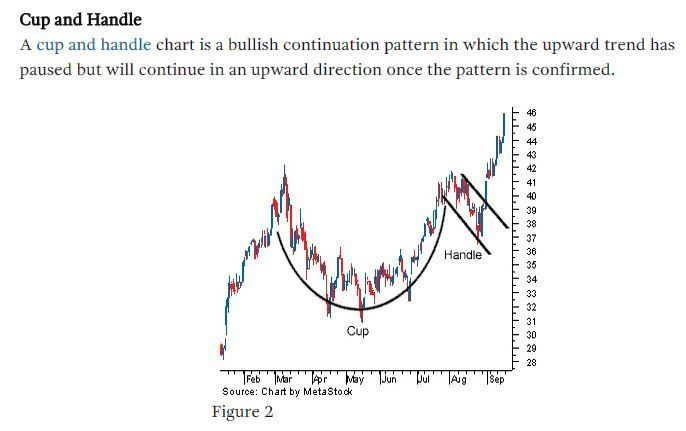

You might think I’m overexaggerating here, but not at all. Take a look at this article from Investopedia, a serious website on investing if there ever is such a thing:

Seriously, guys? SERIOUSLY??????? The part on moving average I could tolerate, but that? “Guys, the stock just formed a cup and handle, it’s going up!!!”

WOW!

Of course they managed to find a case where it worked. But what about this one:

It didn’t take me all that long to find that pattern, by the way. Two minutes of looking at GPRO, TSLA and AAPL and there goes your cup of tea pattern.

These guys don’t know where to stop. I mean, just look at this crap:

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:introduction_to_chart_patterns

It’s not no longer a “heads and shoulders” patterns, now its a “head and shoulders and neckline” pattern. As if the original version wasn’t stupid enough already.

And because the neckline is skewed, this means the stock is going up? Did I follow this right?

Technical analysis has one advantage: it’s easy to explain to idiots

Let’s face it: 95%+ of people suck at math. My first girlfriend failed her grade 10 maths and somehow managed to end up with a masters in biology. I once taught a college-level class that was an introduction to algebra and half of the students couldn’t solve a linear system with two variables. This is supposedly a class of people who graduated high school and saw derivatives, integers, matrices and so on. I once had a student ask me what “<=” was. Really. And this was for a maths degree!

And don’t get me started on the logic class I took where a quarter of the students never understood the difference between “or” and “xor.”

If people suck at math, how do you expect them to understand the most intricate details of the stock market? I remember when I first saw the proof to Black-Scholes. I think I was in undergrad and the teacher saw this:

“Okay, we are going to skip this part of the proof because it’s too complicated. Just assume it’s true.”

What kind of mathematical proof is that? Is this really how math work? I wonder if that’s how Fermat’s Last Theorem was proved. “Guys, this part of the proof is too complicated, so just assume it’s true, mkay?”

Years later, in grad school, I finally saw the full proof and quite honestly, it’s not even that complicated. But when three quarters of your students can’t even apply Black-Scholes correctly (sigma, what???), how do you expect them to understand the proof of it?

And here comes technical analysis. Any idiot can understand the concept of moving averages, oscillators, bands or whatever it is you’re using. “Oscillator,” isn’t that mysterious, spooky-in-a-good-way term? Even if you don’t know how a moving average is calculated (lol!), most programs do it for you today. You click a button and bam, moving averages appear.

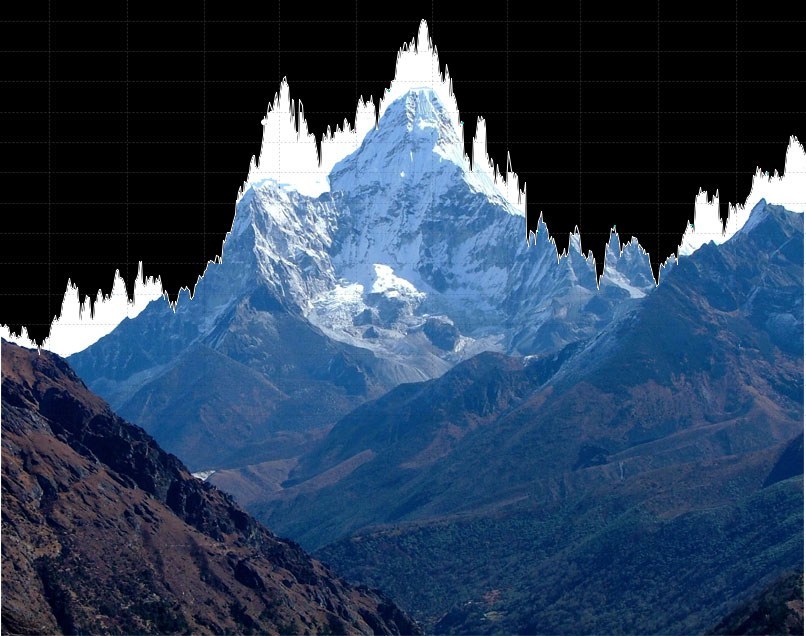

And patterns are even more simple. You don’t even need to know what an “average” is. You just look at the chart and pretend to see stuff that doesn’t exist. Look:

Is it just me or is Apple’s stock price closely following the Everest mount? Every little peak is perfectly correlated. I call that a “perfect fit.” All along, it was all planned guys. This is basically a sign from the Illuminatis. If only I had known that five years ago…

Technical analysis is easy to sell to idiots. No matter the stock, you can usually find a combination of “technical analysis indicators” that would have been true over a given period of time. This makes trading look trivial: just follow a few rules and that’s it, you’ll beat the market. Stock falls below its 200-day moving average? Sell. RSI is too low? Buy. A triangle is forming? If it breaks out of it on the upper side, buy, down side, sell!

As long as you can click a button, you can apply technical analysis. Of course, it doesn’t really work like that. All of this and I still haven’t come to the real reason why Technical Analysis is 100% bullshit

In my entire life, I have never, ever met a single trader who beat the market on a risk-adjusted basis for an extended period of time using technical analysis.

Never, ever, ever, EVER. I can’t name you a single person and, trust me, I have met a lot of people who trade.

Now, let’s clarify something: I’ve met a LOT of people who SAID they made a lot of money from technical analysis, but who were actually using a totally different system. What people say and what people actually do are two different things, guys. It’s very easy for a trader to use a proprietary system and then backtrack the technical tools that give the results most similar to their trading algorithm, and then pretend their result is all due to technical analysis. In fact, people do it all the time. Why? Because they obviously don’t work to sell their REAL system and their REAL secrets, so they invent a bogus “co-system” that they can easily pass down to the morons.

I’m not saying technical analysis won’t work in the short term. I could very well go to the casino tomorrow with a “system” to beat the house at the blackjack game and quadruple my money. I could very well repeat my performance for two, three, four, maybe five days in a row. At this point, if I was dumb, I would probably believe my system is working. But just because you got lucky a few times in a row doesn’t mean you found something valid. The proprietary firm I worked for used a lot of Technical Analysis and it always worked - until it didn’t work. A guy who had been trading successfully for two and a half year got fired for losing half his portfolio in three days. “But, but, the technicals! It worked before! This is a mistake!”

Don’t fall in the trap of technical analysis

Confession: when I first started trading, I read everything about Technical Analysis I could put my hands onto. I went ahead and bought all those funny fancies book that they tell you to buy and that you can find on Amazon when you type “Technical Analysis.” Most of them had 4.5 and more stars, wow!

I studied graphing, charting, pivot points, candlesticks, you name it, I save it. Thankfully, I never actually did trade using them. I would have been humiliated if I had actually followed through that bullshit, I mean, I consider myself smarter than that. Still, I wasted a ton of very precious time actually learning about this crap.

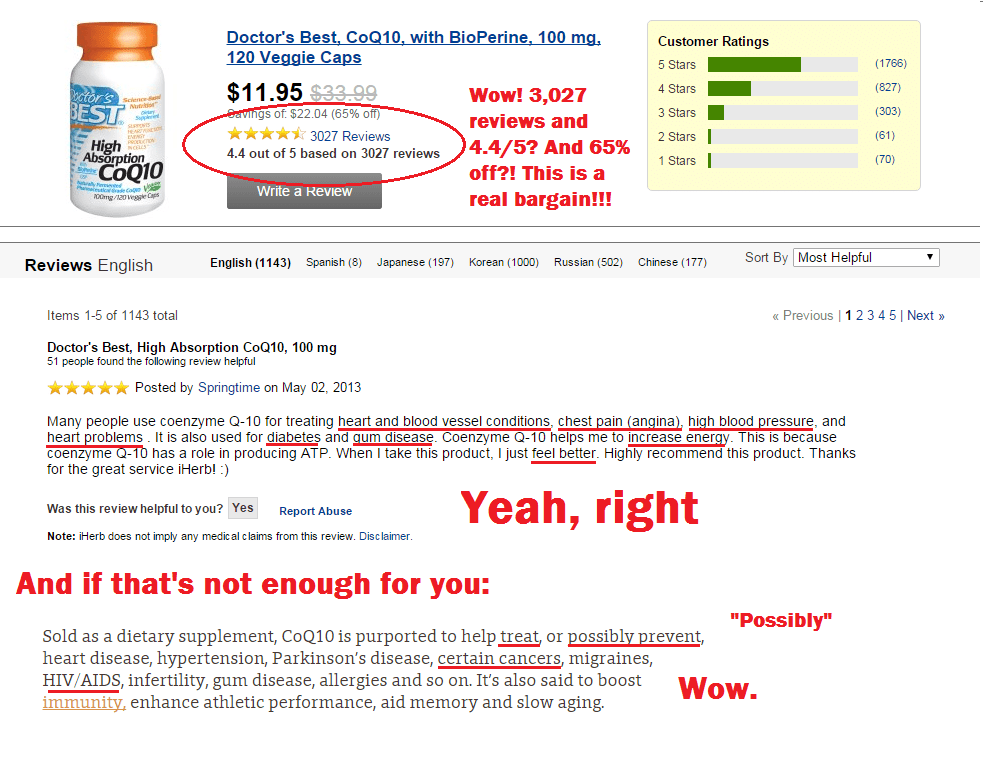

I think it was around the middle of the fourth book when I realized, “Wow, this is some pure bullshit.” It’s like when you go to iherb.com and check the reviews for their “top sellers”:

Technical analysis can “possibly” make you money, guys. Possibly. The rock I’m holding my hands right now can possibly make you immortal. You don’t know that and until someone dies while holding it, you have no proof it doesn’t work!

Listen, guys: just because someone says something works doesn’t mean it actually works, okay? And just because a large number of people say it work doesn’t mean it works neither. By the way, I love the expression “help treat.” It doesn’t “treat,” it “helps treat” okay? It’s like when you have cancer and you undergo chemotherapy and eat carrots afterwards. The carrots “help treat” your cancer.

Making money trading is difficult, tedious, stressful and requires an extreme amount of work. Period.

You can’t make money consistently by with technical analysis, period. In fact, this is the modern day version of a guy going to the casino with a “system.” But no if you had to remember one thing about this whole article, let it be this one: never buy any program/software/coaching/whatever on technical analysis. It’s all 100% bullshit.

If you really had a system that allowed you to print free money trading stocks, would you share it?