For the past 5 years or so, I’ve been shorting VXX. I short more everytime it spikes, which is not that often.

The graph above is not lying, by the way: VXX really is down from 2,723.20 to 37.30. It’s a average minus 57% return per year in case you can’t or don’t know how to calculate. It’s up to a point where it’s almost not worth it to buy stocks anymore. Look at the one year performance:

Down 51% year over year, with the VIX (implied volatility) staying about the same.

Why?

Because VXX is a garbage product: it’s basically designed to go down. In simple words: VXX loses 5% of its value every month. Every. Month. If you need a clearer picture, imagine a huge reservoir holding a lot of water and imagine someone shot a rocket and made a huge hole in it: that’s basically the story of VXX.

Nobody should ever buy it, but someone, some people, somewhere, for some reason, invest in it.

“I am buying a product that loses 50% per year! I must be some kind of genius!”

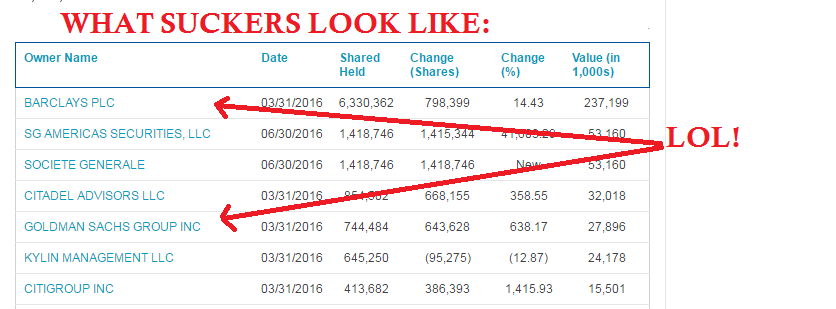

The picture I am about to show you is one of finance’s unresolved mysteries:

Big banks holding a product losing 50% of its value per year - brilliant. At least now we know what caused the financial crisis. I can’t believe Barclays is holding $237M of a product that is basically worthless. One might mention some kind of hedge against volatility, but there are far better, more viable ways to protect yourself against volatility. And of all the people who should know that, big banks ought to be near the top.

I’ve made a fortune shorting VXX over the years. I wait for a tick up, then I short. Even if the volatility remains high, VXX is sure to go down because it crashes every month anyway. Sure, it doubles up from time to time, and if you short at the wrong moment, it sucks for a while, but otherwise, it’s just free money. Unless there’s a next major crisis, by shorting VXX, you are getting an easy 5% average decay per month. And the borrowing fees are next to nothing to - something like 2% per year since the product is easy to short. For some reason many big players (as shown above) like to hold it.

Shorting VXX is like printing free money. My advice: short a constant amount of dollar every month (i.e. shorting $1,000 worth of VXX every month or so).

By the way, VXX recently did a 1:4 reverse split because it became a single-digit stock. If you were shorting 1,000 VXX, you are now shorting 250 VXX. And it’s still going down in flames. Hell, “in flames” might be putting it lightly.

Yeah, especially right now it is probably the best time ever to consider shorting VXX.

Damn, I am going to sell my house and short the hell ouf of VXX on margin and I am looking to load short term out of the money put options as well. What makes me especially excited is that some scumbag bankster on the other side of my trade will lose big…

I see no flaws in the logic at all. One guy in the internet supposedly has been doing it for years. What could possibly go wrong ? The idea is simply brilliant.

Thanks for sharing!

Actually now is a terrible time to short VXX! Implied volatility is too low. Wait for it to spike, then mass short VXX

When do I short VXX? Please help me grand wizard!

When do I short VXX? Please help me grand wizard!

http://truecontrarian.com/09_08_03.htm

This goes back to when VXX was relatively new-I know you want to hurry up and subscribe-warning he is still out there giving advice. 🙁

http://truecontrarian-sjk.blogspot.com/

Wow.

Dear F.S. Comeau,

I strongly object to reprinting an investment recommendation from several years ago as though it were still current. I think you will see from my history of more than 20 years on the internet that I have a very good track record of buying and selling and that my managed accounts have gained over 70% during the past year. I am officially registered with the federal government under finra.org (look for Steven Jon Kaplan) and I would be pleased to discuss my lifetime trading record any time if you contact me at (201) 246-0003.

I would suggest including a link to something I have written more recently and seriously considering whether it is worthwhile or not. What goes around comes around; there are short-term opportunities in 2017-2018 to buy VXX and more intelligent long-term ways to play the 2017-2018 bear market for U.S. equities which will likely result in a total loss of over 60% for the S&P 500.

Yours sincerely, Steve

>long-term ways to play the 2017-2018 bear market for U.S. equities which will likely result in a total loss of over 60% for the S&P 500.

Okay……………………

Dear Mr. F.S. Comeau,

Your response is a bit unclear. I expect the Russell 2000, S&P 500, Nasdaq, and most other U.S. equity indices to drop by over 60% from their recent peaks until their bottoms in 2018 or 2019. There are many ways to benefit from this downtrend, including directly selling short those exchange-traded funds with the biggest net inflows in recent months which almost certainly indicates overexcitement by amateur investors. Those with components that have suffered the heaviest insider selling are also good choices, since top corporate insiders have a good track record of getting out near the top.

For those who have retirement accounts where short selling isn’t permitted, buying HDGE will likely result in gains which outperform most bear funds. HDGE, unlike most funds, doesn’t have futures, options, and all kinds of what I call artificial preservatives.

At least this is being published in real time instead of seven years later. Imagine reprinting a recommendation from seven years ago as though it were current-that makes no sense.

Yours sincerely, Steve

VXX operates exactly like insurance. It spikes during times of fear because it is made of bullish options on the VIX. Large companies buy this fund to hedge their bets of the future and especially if something like 2008 were to happen again. In that case, they could still maintain some liquidity.

Is this a troll post or you are actually serious?