I have a confession to make: I don’t really like economists.

It goes back to my time as as undergrad student, I suppose. I was forced to take three economics classes and I still resent the university for it (no way they are ever getting donations from me). Those were the most dreadful, boring and useless classes I have ever been forced to attend, safe perhaps for that one class on pension plans that forced me into lifelong therapy.

My economics classes were: a) microeconomy, b) macroeconomy and c) economy. Now, I don’t know if the last one was simply a merger of the first two, but I can honestly say I saw no difference whatsoever between all three of them: all my economics classes were completely useless and taught me practically nothing. Take this quote from my microeconomy teacher which I shall never forget:

If someone has $5 in his pocket and wants to buy a piece of pizza that costs $4 and a soda that costs $2, he can’t.

What an invaluable piece of insight! I remember noting it five times in my notebook to make sure I would never forget such an amazing lesson. Since then, I spend my entire days with $5 in my pockets near pizza stands wondering whether I should buy a pizza and still have a dollar left, or a soda and three dollars left. Or two sodas, I guess?

Anyway, back to deflation: it’s the more overrated, unimportant, overrated concept in the entire existence of mankind.

What is deflation?

Deflation is when prices go down.

That’s it?

Yeah. If a pack of Oreo cookies used to cost $1.00 and now cost $0.90, you just had a deflation of 10%.

I just saved you from a 3 hours class on inflation and deflation (with half the class still not understanding that when the price of something goes down, it’s called deflation). Trust me, I had that class.

Why is deflation a bad thing?

It’s really not. But according to the theory, if prices are falling, customers will delay their purchase, which will hurt the economy (in theory).

For example, let’s take a car worth $20,000. Now, let’s say you expected the price of this car to fall 10% tomorrow. Would you buy this car today at $20,000 or wait until tomorrow to buy it at $18,000 instead?

This, according to morons economists, create a “deflationary spiral,” because people will delay their purchasing decisions forever and never, ever buy anything ever again. For instance, let’s say you expected the price of a car to drop 10% every day:

| Day 0 | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 |

|---|---|---|---|---|---|---|

| $20000 | $18000 | $16200 | $14580 | $13122 | $11810 | … |

If you wait barely 5 days, you can buy your car at nearly 41% off. So why would you buy your car today when you could buy it for much cheaper later on? If the trend above is expected to continue, why wouldn’t you wait 10 days, 15 days, 50 days or even 10,000 days to save an even bigger amount? And this is where the stupid term “deflationary spiral” comes from.

Based on that premise, in a deflation world, nobody is ever going to buy anything ever again, and that’s why deflation is “allegedly” bad for the economy: people will wait for prices to go down instead of buying now, and since nobody is going to be buying anything, the entire economy will crash to 0.

Okay, and why do you say economists are wrong?

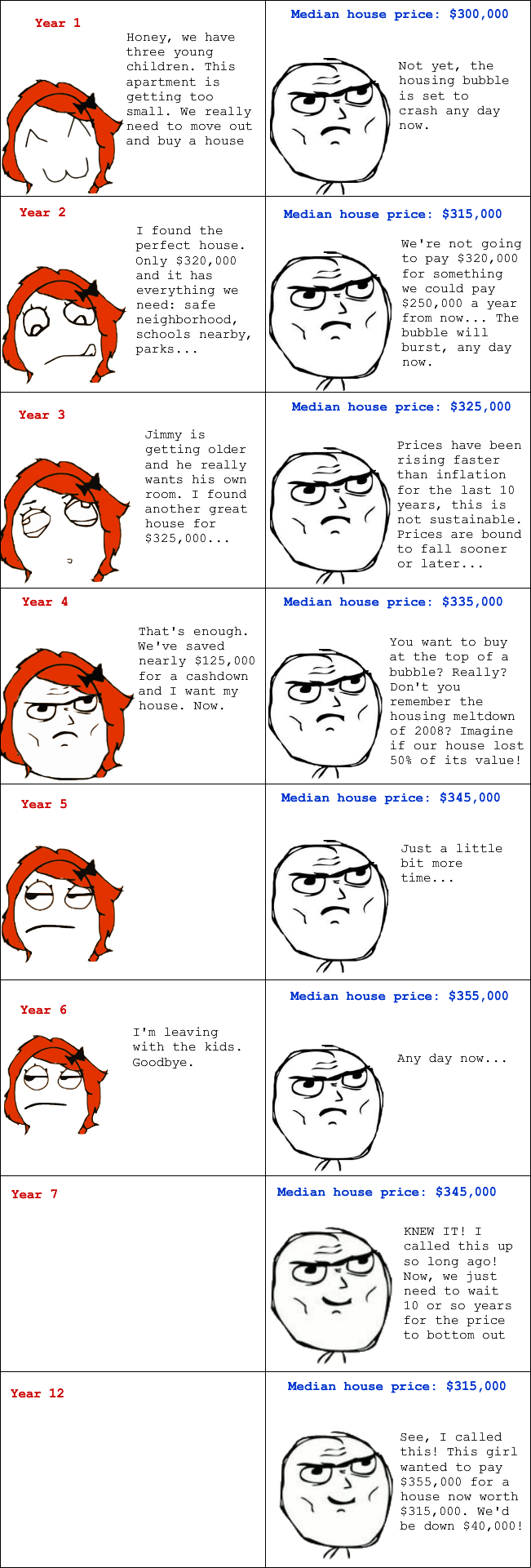

I’ll let my second rage comic explain:

This is how most economists see the world

Do you see how silly that is? Economists have no idea how the real world, with real people, operates. Nobody is going to base his major purchasing decisions based on what the Bank of Canada or the Fed says about future inflation. Sure, models designed by economists work - if everyone was immortal, could use teleportation, didn’t need to eat, drink, breath or do anything at all to remain alive, and if everyone was perfectly logical, could use telepathy at will and had absolutely no needs, desires, aspirations or dreams, ever.

In the real world, when someone needs a car, he needs a car, and deflation and inflation are literally the last thing a person can care about. Nobody is going to start computing deflation rates and develop a model to obtain an optimal purchasing time. If people were purely logical, as models imply, nobody would ever buy coffee at Starbucks, an iPhone, an Abercrombie and Fitch jeans or a $80,000 car.

And we still haven’t even touched the most important point of this article:

Deflation doesn’t even exist

In my entire life, I can sincerely say I have never, ever seen the price of absolutely anything go down, ever, ever, so for me, deflation is and remain a myth. Oh, sure, it must exists somewhere on the globe, in some third world country no one cares about, but not here. Don’t believe me? Name one item that has gone down in price over the years.

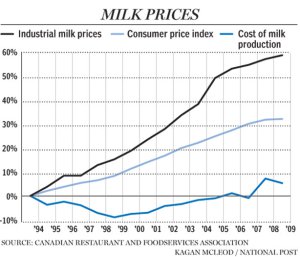

Here’s how the economy work in reality: prices go up, not down, and even when they are supposed to go down, they go up. I’ll call this the “FSComeau Theorem.” When the cost of base materials rise, merchants increase their prices to keep their profit margin intact, but when the costs of base materials go down, merchants keep their prices steady instead of lowering them and increase their profit margin instead. It shouldn’t work like that, there should be laws to protect consumers, but no one cares, or at least no one cares to do anything about it and, as a result, nothing is being done about it. Take milk for example:

Yes, the cost to make milk was basically the same in 1994 and 2006, yet the price had soared over 50%. What an utter scam. Even if inflation was to turn into deflation, you can be sure those thieves would still increase the price of milk year over year. Literally the only thing I have seen fall in price in my entire life were computers, and only when you compare computers from another era with computers today, arguably a totally different product with totally different uses.

I’ll try to make things clear: deflation is a myth. It doesn’t happen, it never will happen and you’d be better off believing in the Kraken rather than this economistic legend. Trust me: no price is going down, ever, as long as you live or as long as your grandchildren live.

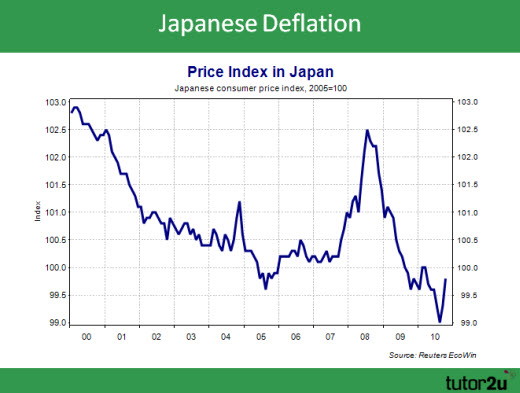

But but but Japan!

In ten years, prices fell 3% overall. That’s a decrease of 0.3% annually. Back to the ragecomic above - can we agree no one is going to delay buying a car because they “may” be 0.3% cheaper next year? Yeah, I thought so.

By the way, Japan is having deflation because their population was growing at a ridiculously-low speed, and is now actually declining.

One element that creates inflation (the opposite of deflation - another 3 hours class here that half of people still don’t get today) is that when there are more people, there is more demand for a product and, thus, the price of the product tend to go up (not always, but there is a certain momentum towards it). With a smaller population, or a population that grows more slowly than what is needed to sustain normal economical growth, there is indeed a deflationary pressure. For instance, let’s say you need 100 Big Mac to feed 100 people. If there are still 100 Big Mac but only 90 people, the price of a Big Mac should fall. Textbook supply and demand here.

The truth about deflation

Deflation is a grossly exaggerated concept with little factual basis meant to scare people and lure readers into reading clickbait junk articles and giving credit to idiot economists who charge thousands for their baseless and tasteless “opinion.” Economists love to throw that word around because it sounds “in” and people will readily understand it and react to it. After all, think of how unserious this alternative wording would sound: “This is horrible! You might save money next time you buy something!”

Per se, deflation is neither better nor worse than inflation. Take this quote from NPR for instance:

Europe’s long, slow economic downturn has taken its toll on Javier Oroz Rodriguez, who owns a butcher shop in downtown Madrid.

“We’ve lowered our prices, in various stages, bit by bit,” he says. “So now we’re charging about 10 percent less than we did a few years ago. It’s really difficult because I’ve got expenses. So it’s tough.”

Things aren’t all bad, however. He says the prices of some of the meats he buys have come down, so his costs are lower too.

So let me clarify this: the prices of meat went down and you lowered your prices? And… that is somehow a bad thing? And I am supposed to sympathize with you? “Guy, my car now cost $5,000 to build instead of $6,000. But I have to sell it $19,500 instead of $20,000! This is horrible! Deflation! The entire economy is crashing!” Someone get the violins out, please.

For once, prices are going down, and consumers benefit. Isn’t that a good thing? Shouldn’t we let prices adapt to their environment instead of artificially propping them up? Shouldn’t sales price factor costs in the equation at some point? If oil fell 50%, would you expect gas prices to fall? Yeah, I thought so. If something cost less to make, it should sell for less.

Since when are lower prices not a good thing anyway? Should we just let merchants increase their prices (and profits, which the article doesn’t even begin to address - you have no idea whether Mr. Rodriguez makes more money today when compared to a few years go) year over year, no matter whether the raise is justified or not, just to have the illusion that things are going well? “Wow, the price of milk has gone up! I guess the economy is doing well! I’m so happy that I have to spend more money to maintain my standards of living!”

What’s so likeable about inflation and prices going up anyway? Why should I be happy about the fact electricity is going to cost 3.5% more next year? Because someone, somewhere will stand to make a few more millions? Please. I’m so sick of all those robbers making millions upon millions year after year, then complaining and bitching that one year their profits drop 3%. “Bail us out! Quick!” These guys are the first to cut your wages, ask for extra unpaid hours or lay you off when things start to go even so slightly bad and they expect me to root for them and complain when prices go down? No. I say that if prices are to fall down, then let them fall. For one, we the consumers will be benefiting.

Overall, while it is true in theory that people have an incentive to wait to make major purchases when prices are falling, the effect is too small to even matter the slightest and in the grand scheme of things, nobody seriously considers “deflationary expectations” before making a purchase. It’s a grossly exaggerated concept that means absolutely nothing and it shouldn’t keep you up at night.

But if prices go down, companies make less money!

Not necessarily. First, if prices go down, sales should normally go up. Textbook supply and demand and here. Let’s say beer fell in price to $0.10 per beer, would you drink more? Let’s say lobster prices plummeted to $1 a pound - would you eat more lobster? Let’s say a new car was now $8,000 - would you be more tempted to buy a new car?

Incompetent lazy idiot overpaid managers these days are looking for any excuse to justify their numerous shortcomings and failures and, often, it involves putting the blame on something that has absolutely nothing to with the situation at hand. It’s simply not true to state that if a company lowers its price, it stands to make less money. That’s a gross oversimplification of things at best. According to this logic, no seller should ever offer any rebate on its products because “it lowers profits!” Someone tell Groupon they got it off - after all, no company should do business with coupon websites since they have to offer their product or service at a massive discount, right?

All in all, lowering prices simply means having a bigger piece of a smaller pie. If you sell 1,000 items at a $10 profits per item, you earn more money than if you sell 500 items at a $15 profits per item. How hard is that to understand? Oh, and it’s not a given fact that profits will fall, neither. Take a product that cost $500 to make that you sell for $1,000. If the cost drop to $400 and you sell it $900, you still make $500 per sale and you stand to make more money because lower prices will entice more buyers.

Overall, it’s simply not true that deflation is nefast for the economy and, if anything, free market is a good thing for consumers (if it existed) and a sane economy where business can compete fairly (another myth) and prosper not due to artificial yearly price increases, but due to their hard work, business acumen and dedication.

Housing market

I can’t end this article on deflation without mentioning the housing market because I grew tired of idiots claiming that “house prices have risen way too fast” and that there was a “massive housing bubble about to burst! House prices will crash 50%!”

Take this quote from another of those idiots economists live on CNBC no later than yesterday:

Housing prices have risen extremely fast over the last few years - much faster than inflation - and, as a result, people today will delay their decisions to buy a house, while waiting for the prices to come down.

Now, to be clear:

This is how economists envision people who are buying their first house

I can’t believe that anyone give those economists any credit. It doesn’t take a Ph.D. in the field to understand that people buy things when they need them, not when they believe the housing market is at the bottom. “Oh, the head economist of the Bank of the United States just said housing prices have reached a bottom and are going to rise from now on… Guess I’ll have to go buy a house then!”

Nobody is going to pull out ten pages of economic projections (which in themselves are at best wildly inaccurate and a wild guess of things to come) to make sure now is the good time to buy. They’ll wait until they actually do need a house, they’ll find one they like, they’ll negotiate the price and if everything is fine with them, they’ll buy it. The fact is that when you need a house, you need a house, period. You’re not going to wait 10 years of your life for the price of a house to fall down just for the distant possibility of saying, “ha ha! I bought at the bottom!”

But what if the price of your house does comes down!

This is something I’ve been trying to explain to a lot of people for a very long time: as long as you don’t sell or don’t plan on selling soon, why should you care about the market value of your house? If it falls, who cares? You’re not going to sell anyway, so even if it had raised, those are imaginary dollars at best. If anything, you want the price of your house to come down so you’ll (perhaps - see my part on milk. Taxes are another thing that never go down) pay less municipal taxes!

The example also applies to stocks. Take my Alibaba stocks for instance. While I am always very happy to see them appreciate in price, I don’t plan on selling anytime within the next 10 years, so why would I care whether they rise or crash? Alibaba went down from $119 to $105, so what? They’ll be at $500+ a few years from now anyway. Am I panicking, “Wahhh I lost $7,000!” Not even a bit.

“But F.S.., you could have sold at 119 and tried to rebuy at $105!” Yeah, but there is a name for that kind of trading, and it’s called gambling. Back when I was younger, I tried to do exactly that: I sold my stocks of one of those companies at $60, hoping to rebuy it at $50. It promptly kicked up to $65, then $70, then $85, then at $100 and today, it sits at over $250.

That’s company’s name?

Visa.

Yes, in theory, economists are right. Yes, in theory, when Tim Hortons raised the price of its coffee by ten cents a few weeks ago, it should have caused a drop in sales. Yes, when house prices rise, the number of buyers should decline. But none of that happened, happens or will happen and you know why? Because we don’t live in a stupid economical theory that was materaliazed in the mind of an economist trying to make a name for himself after taking life a little too easy during his stay in college: we live in reality, and in reality, people don’t give a damn about what models state they should do.

Deflation is a myth and everytime you hear an economist who is trying to scare you with it, change the channel.

I laughed. That was hilarious. I hope to God it was satire. Otherwise, God have mercy on you.

Why do you have to bring up God? What does God has to do with anything?

It would have been better had you paid attention in your classes.

hey man, I don’t mean to be rude but before you go dissing fairly well established fact and people far more established than you, you should learn to write better than someone in grade school. It doesn’t read like a college grad, it reads like maybe a first year unfamiliar with economics.

If thats all you learned in econ thats your fault that you were dealing with perfectly rational models, most of economics after the basics is understanding people dont have perfect information so how do they make decisions based on this imperfect information. Look up behavioral economics.

Over the long term commodity prices recover from deflationary risk because our economy has been quite lucky to not have a long term deflationary cycle but I’m going to post some charts that show that in short term price action (months-a couple years) there’s been plenty of good prices that have fallen significantly, the effect that has on spending is something to research but Bernanke and others have spent their whole academic career studying this and you haven’t.

http://finviz.com/futures_charts.ashx?t=HG&p=w1

http://finviz.com/futures_charts.ashx?t=CL

http://finviz.com/futures_charts.ashx?t=SB&p=w1

http://finviz.com/futures_charts.ashx?t=KC&p=w1

http://finviz.com/futures_charts.ashx?t=JO&p=w1

http://finviz.com/futures_charts.ashx?t=CC&p=w1