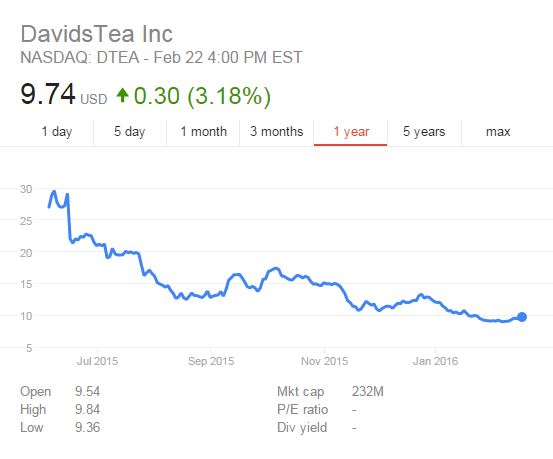

I’m a huge fan of tea in general. Ever since I cut soda/milk/juice completely, hoping to finally get an BMI under 40, I’ve been drinking around 10 cups of tea per day. Of course, anyone who truly knows tea knows David’s Tea, yet its IPO was one of the biggest disaster of all times:

This graph just screams “pain” to me. It also screams “never buy an IPO again.” For a new company to lose two third of its so-called value in 6 months is mind-boggling, especially if you consider the fact NASDAQ:DTEA is a consumer product company. This would be the equivalent of SBUX crashing 70% in three months: in other words, a disaster.

Perhaps some will attribute this fall to the fact that DTEA is a new listing and thus more risky. Perhaps some will compare it to CMG, which also lost nearly 40% of its value in a month, or add that the general market went very poorly during that same period. But to be completely blunt, nothing really compares to this catastrophe illustrated above.

David’s tea IPO had a lot going for it: it priced above the company’s range ($19 instead of $17-18), it jumped 42% on its first day, it was backed up by Oprah, et cetera. So why the crash and, more importantly, why do I believe it’s going even lower? The answer fits in one word:

Fad.

David’s tea has absolutely no lasting, sustainable advantage of any kind. It was perhaps the first mover (at least large-scale, then again I’m not sure), but as the hype dies down, one comes to realized David’s tea is just a company selling massively overpriced tea. There, I said it: David’s tea is overpriced as hell and I can get 95% of the quality for 25% of the price pretty much anywhere else.

I wish there was a better way to put it, really, but that’s what it is: David’s tea sells really, really expensive tea. Is it great tea? Absolutely, but you don’t build a dynasty out of one single product, especially one that is easily copied and even improved upon by pretty much 500 different competitors.

Nobody goes around boasting “I got this tea for David’s tea!” like they might do with their iPhone, their cars or even their clothes. There is no “mark” to be build here because tea is an easily switchable product. If you switch one of David’s tea “$1 a cup” product for a teabag worth $0.10, I doubt 99% of people would pick up the difference, so why bother?

Is the product offered by DTEA good? Absolutely, in fact, I enjoy their product very much, but it’s not good enough to justify an entire business and especially not one listed on the stock market.

David’s Tea biggest problem: product fatigue

I started to dislike David’s tea when I realized that I never finished any product I bought from them. I must have over 30 unfinished bags that I just don’t feel compelled to drink for some reason. Some of those bags are several years old and I still keep them in tea stash, trying to convince myself that “one day,” I will drink them. With so much unused product that I paid for, why would I go to a DTEA store to buy even more tea that I’m probably never going to buy?

There are simply too many good options to buy tea. Just within a 5 miles radius, I can name ten stores that sell tea, most of them at a fraction of the price of David’s tea. Once you get over the idea of paying $1 to make a tea that you could pay $0.10 for, you start to grow tired of the entire ordeal. For $15, I can get 100 bags of high-quality green tea for Costco that I will neither have to prepare, nor measure, nor clean afterwards. Why would I pay more than four times that for barely better at DTEA?

Prices are too high

I went to a David’s tea recently and they tried to sell me a $50 package that contained ten different teas, a mug and some weird accessory. There is no way I am ever going to pay $50 on tea no matter how you present it. Whenever I enter a David’s tea, the maximum amount I am ready to pay is $20; perhaps $25 including if it’s a gift and I’m tired of searching around. The last time I went, the prices plain and simply turned me away. Back a couple of years, you could still get two bags of tea for around $5; today, it’s almost impossible to get out without spending $30.

Oh yeah, there was a box that was selling for $100. For it, you had a mug plus 30 different tears. A nice deal when you consider that each tea will cost you $3.00+. That’s the price of a beer, a really good one in fact, and there is no way I will pay as much for tea as I pay for a good beer.

Valuation

At $255M, David’s tea is valued at roughly $1.5M per store. It has a grand total of 168 stores right now and hopes to be at 550. This is simply impossible. No matter how you look at it, there is no way in hell David’s tea is going to end up with 550 stores given its current market cap anytime soon. It’s not even daydreaming, it’s pure dementia. Shake Shack has 55 stores, yet is valued at $1.5B. It would make more sense for Shake Shack to have 550 stores, if anything.

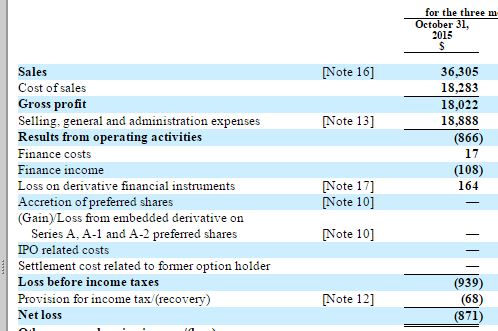

At $255M, David’s tea is probably correctly valued given its high cash-on-hand ($48M after the IPO) and non-existent debts. It litteraly has no long-term debt for some reason. For what matters, their financial statements, especially their gross margins, are very interesting:

In fact, that balance sheet is quite impressive: with a gross margin of roughly 50%, you have a very attractive business from a shareholder’s point of view. If somehow there was a scale saving to be placed, DTEA would indeed be worth a fortune; then again, with “if,” you can pretty much come to any conclusions. If, if, if…

Of course, none of that explains why DTEA used to be valued at $800M, or 8 times its annual sales, but it is definitely doing better than many businesses with great sale increases and potentially a lot of room to grow as well. In a few years, if it wants to, it can be slightly profitable, I think; perhaps a few cents per shares in profit, which still doesn’t support a $9+ stock price. All in all, DTEA seems like an okay business: not bad enough to bash it, but not good enough to invest in it.

Unfortunately, DTEA faces the structural problem I exposed above, combined with a total lack of profitability. After 8 years of existence, I expect either a super-growth, which DTEA doesn’t have ($100M sales / 168 stores = $600,000 sales per store, which is just horrendous), or a high net profit margin with perhaps an eventual dividend. David’s Tea has neither of those.

Overall, it’s just not an interesting business to invest in. Too many question marks and too few answers. I fail to see how anybody would pay $25+ per share for this. It’s too small, ripe with problems and easily reproducable and beatable.

Bankruptcy?

My ultimate guess on David’s tea would be for the stock to stagnate at $7-8 for a couple of years, then for the company to simply disappear. Unfortunately, David’s tea can do little to prevent it. While it could become profitable if it wanted to, my guess would be for it to remain unprofitable for 5+ years. This, combined with new store openings, will be a massive drag on cash. David’s tea will run out of cash somewhere in 2017 or 2018 and it will have big problems selling new shares with a deflated stock price. It could target the debt market, but given its size, the interest alone might eat it. Some kind of hybrid/convertible makes sense, but that would dilute current shareholders in the event of a success.

David’s tea will close because unlike Starbucks, it has no lasting advantage. Sales per store will eventually plateau, if not go down, as the fad dies down. David’s tea will need to close some stores and I see it snowballing from it, up until the point where it only have a few dozen stores that are actually profitable, the rest of them operating at a massive loss. After several years of burning money, it will either be bought out or simply close down.

I think any dollar invested in David’s tea today will disappear a day or another. I wouldn’t bet on it surviving for too long. I have to admit the managers do a good job, but I don’t see them facing the wave for very long - not at a valuation of $252M, in a market dominated by massive players.

Good read FS.

BTW: I find it interesting that DTEA is failing selling overpriced tea while SBUX (who you mention in the article) is killing it doing the same thing with coffee.

Don’t get me wrong, I love SBUX and it’s my best stock right now but it does kinda puzzle me as to how successful they are.

I’m not really clear on what they are doing so much better than a DTEA for example.

Maybe DTEA is marking things up too much? (honestly I have never even visited a DTEA as it seems to exude overpriced yuppie crap).

SBUX is led by competent people; it also does more than sell overpriced tea, it sells an image, a culture and a lifestyle. You know what “Starbuck people” are? Much like iPhone people, or NASCAR people, or even Gatorage people, SBUX has suceeded in creating an ecosystem. Its high margin and outstanding management guarantee a 10%+ return for at least the next 10 years.