A couple of days ago, someone sent me a link to an article about one of the companies I’ve reviewed, FreshPet. The article intrigued me first because the author recommended shorting one of my stock picks, second because he actually recommended shorting a strong and popular IPO operating in a high-growth environment.

As I progressed through the article, however, my curisioty and shock turned into rage and anger. In simple words, it’s infuriating that, in this day and age, some people are not only allowed to publish this kind of garbage, but actually get paid for it. What Ariana Research has done is purely nonsensical and nothing short of a market manipulation attempt.

Not, don’t get me wrong: an entire bear (pessimistic) case can be made for Freshpet. In fact, in my original article, I make it very clear that Freshpet is a risky investment. It’s very possible that it could could go to zero. Several companies like Freshpet have crashed and gone bankrupt. But on the other hand, several companies like Freshpet have soared and returned 200%+ in mere years. I did invest a small amount in it because I believe the risk/reward profile is above average.

My issue with Ariana Research’s is not the thesis they want to defend, but the way they defend it. In simple words, they:

- Made misleading and borderline false statements

- Make gross exaggerations and simplifications

- Use unrealistic assumptions that make no sense in any financial words

- Use statistics to hoodwork

- Outright lie to readers

The thesis promoted in this piece of garbage was later echoed by other manipulative posters who have no idea what they’re talking about a bit later. It sucks to say, but those posts actually made it into the popular “Google Finance” categories, where they were viewed by thousands of poor innocent investors, in an attempt to influence goad them into selling, or perhaps even short selling (arguably increasing the poster’s profit, since he is short on the stock).

In this post, I will analyze each of their “arguments” and explain why they are at best misleading, at worst completely false and fabricated.

Introduction

One of the biggest problem of this article (aside from it being almost 100% wrong and extremely manipulative) is that it was clearly written by someone with little actual background in finance and economy in general and this very factor jumps to your eyes in the first few minutes. Overall, given the overly stylistic approach to this author’s analysis (there is nothing wrong with writing well when you do an analysis, but in my opinion, the content is more important than the form), it is clearly an attempt to both drive down the stock price and lure more readers at the expenses of factual information.

You can guess from the very first minutes that this article is plain and simple bullshit. Let’s just start with the first few words:

A newly minted JOBS Act IPO

This is how the author has chosen to begin his article. What does the JOBS Act has to do with anything? For those who don’t know, the “Jumpstart Our Business Startups” act basically makes it easier for small company to get listed on the stock market. So? According to the author, this is a bad thing or something?

Every small company that is listing on the stock market - that is, 75%+ of IPOs - is technically under the “JOBS Act.” This act greatly reduce the burden of getting listed on a stock exchange and makes it easier for company to get access to funds. In itself, the fact Freshpet is a JOBS Act IPO is 100% meaningless.

Freshpet is a low-quality commodity business

First, Freshpet is not a commodity business, second, it’s not low-quality - even the most bearish analyst of Freshpet would have to admit Freshpet makes high-quality, premium products. What the hell is this?

that has managed to spin a tale as a high-growth CPG company.

Do you see what I mean with “cutesy” writing now? You’d believe you’re reading a novel, not an analysis. Look at how petulant his writing is.These are the kind of words you’d use if you were copywriting. “One weird trick to make billions out of the stock market!” “This stay-at-home mom earns $5,425 per hour!” This would be fine if the analysis was solid, truthful and direct, but it isn’t.

The main problem here is that the author exposes his opinion as facts. He insinuate Freshpet to be nothing but hot air and outright lies (despite the fact Freshpet went through a thorough check to get listed), but brings nothing tangible to back his statement safe for his relatively elegant writing style and half-assed guesses.

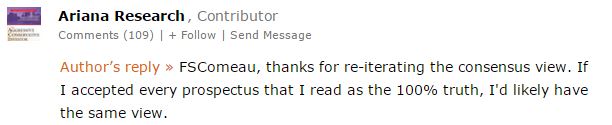

For example, he claims that Freshpet’s growth is “nothing but a tale,” but his thesis is not backed by any actual evidence. When you look at the prospectus, you immediately discover that Freshpet IS in fact a high-growth CPG company it is. In one of his replies to my comments, Ariana Research wrote this:

Yes, this guy is literally accusing a $500 million company of blatantly lying in its prospectus, a document that has been audited and verified by certified accountants and financial analysts. Can you believe the nerves of this guy? He is basically accusing Goldman Sachs and Credit Suisse, the managers of the IPO, of not only lying to investors, but of committing direct financial fraud as well. Do you really think these two financial behemoths would waste their reputation on this? A $500 million IPO? Really?

Since its founding 8 years ago, FRPT has not managed to generate profits,

Obviously not because it has reinvested all of its revenue into its growth.

a tremendous failure considering FRPT is fully penetrated in PETM/Petco, and is reaching saturation in its remaining product channels.

Do you see what I mean now with “manipulative writing?” This kind of approach can be used for every company. Add in some cute words to hide the lack of substance and you’ve got an article on your hands. How is “not managed to generate profits” a tremendous failure? This is like saying, “TWTR has never made a profit!!!!! It’s a tremendous failure!”

Back to the statement, the only point it tries to make is fake as well. While Freshpet is indeed in every PETM/Petco (which is a good thing, I’m not sure why anyone would think being in every shop of a major pet food seller would be a bad thing!), you do realize PETM/Petco are not the only animal food sellers, right? In another of his reply, Ariana Research said this:

At this point, I really thought about simply giving up replying to his statements. The point above is so wrong it could basically be inserted in a dictionary to define what “wrong” means. I mean, I’m seriously not going to comment this part of his reply: you find out why it’s so false.

Back to his inane argument that “Freshpet is everywhere in the world in every store and never going to grow again,” it’s simply not true. For instance, you do realize PETM and Petco are opening new stores all the time, right? Just look here for the most recent ones. Also, there are more that two pet foods seller, and that’s not even counting all the other stores where Freshpet could sell its products (BJs, Target, Wal-Mart, Kroger, Safeway, etc.). And, of course, nothing prevents it from expanding to other countries as well.

Still not convinced? Please read this part of its prospectus:

Our market share is currently less than 1% of the overall $22.5 billion North American pet food market. As of March 2014, less than 20% of U.S. pet food consumers had aided awareness of the Freshpet brand, which provides us a significant opportunity to grow over time.

Back to his next point:

Additionally, the Company’s revenue per fridge growth continues to rapidly decelerate, dropping from ~16% in FY13 to 1.5% in the LTM period.

When you open more fridges in a given location, then yes, the growth of the revenue per fridge will decrease. Note the word, “growth” here. Revenue per fridge is still increasing, but more slowly. It’s quite obvious that if you put 2 fridges within a 10 miles radius instead of 1, then yes, revenue per fridge will be affected. Even a child can get that if there are 2 fridges instead of one in a given radius, then sales for that region will be split between 2 fridges.

For a high-growth concept which the sell-side compares to Chipotle (NYSE:CMG) and El Pollo Loco (NASDAQ:LOCO), the financials simply do not inspire confidence.

Is this guy seriously comparing a dog food company to Chipotle and El Pollo Loco? Seriously? Why am I still reviewing this farce of an article?

Well, I am to show you exactly how someone can write an apparently convincing article that is nothing but hot air. Let’s now look at the main arguments more in detail and why they are totally misleadingif not catastrophically wrong.

Ariana Research’s arguments

Astronomic Valuation In Excess of Reproduction Value and Private Market Transactions

Freshpet trades at ~7x revenues and over 5x its recent replacement value. For a Company that has never generated positive EBITDA or free cash flow, the valuation is highly stretched by all means. The Company will not grow into its valuation. Utilizing its aggressive growth assumptions, FRPT at best will generate only $25MM to $30MM in EBITDA in FY17E, implying a lofty 20x multiple. Furthermore, numerous precedent transactions in the space have been consummated over the past ten years at materially lower multiples: 2x revenues and ~11x EBITDA.

You are comparing “transactions” of fully-valued companies to a fresh, newly-listed IPO company. Also, I have no idea where you get that $25-30MM EBITDA figure in 2017. In fact, later, you will bring a figure of a 85$M EBITDA.

Also, you do realize EBITDA only tell part of the story, right? I guess overall, I don’t understand the argument you are trying to make. That the stock is overpriced? You are surely amongst those shorting GoPro and Alibaba then, right? Even if FRPT indeed “at best only makes” $25M in EBITDA in 2017, this only tells part of the story because FRPT will still be growing faster than its competitors. You are missing the point totally.

Lastly, you mentioned deals with have been “consummated” (oh, cute!). But Freshpet is a disruptive concept and comparing a quickly-growing, novel concept to other stagnating brands of pet food at a totally different time in a totally different market is absolutely inane.

Competitive Space and Undifferentiated Product Offering:

Freshpet operates in a crowded commodity product category, and is highly disadvantaged vis-à-vis regular pet food manufacturers. These peers can stretch overhead over a greater number of product lines, have strong brand names/reputations and are not burdened by the capital spending constraints experienced by FRPT. For example, one strength FRPT mentions in the S-1 is its supply chain management capabilities; yet, distribution and warehousing are outsourced, which implies low barriers to entry.

Highly disadvantaged because of what? Because you say so?

Perhaps the most ridiculous claim so far in your article s your “example.” Did you seriously expect a $500M company to be able to distribute its products to nearly 12,500 and growing stores by itself? I mean, seriously? “Hey guys, I have an idea: let’s manage an entire fleet of trucks able to service the entire country by ourselves!” You have no excuse how logistics work. Yeah, those guys are going to start hiring drivers, mechanics, managers and so on, as well as paying insurance and gas to deliver their products themselves. This argument is just laughable.

In your point, you mention low barriers to entry, which is also wrong. Freshpet has 12,500 fridges established in the country and partnerships with major distributors, some of them extremely hard to get a hold of (such as Wal-Mart). There are clear, well-established barriers for any newcomer, such as establishing a brand, establishing a network, building the fridges and so on.

Freshpet’s product offering is simply refrigerated dog food, which looks eerily similar to a hot dog.

Another empty sentence. You could say this for any company in the world: Apple’s product offering is mostly phones and tablets, which are made by hundreds of companies now. Microsoft’s product offering is simply software, which is being done by a million other companies by now. Google’s product offering is mostly a search engine, which looks eerily similar to Bing, Yahoo, Baidu and others.

When compared to brands such as Blue Buffalo Wilderness dry kibbles and Nature’s Variety, FRPT’s product appears to be severely lacking. In a recent comparison, minimum crude protein and moisture were 9%/76% respectively, versus Blue Buffalo Wilderness at 40%/10% and Nature’s Variety with 15%/68%.

This is addressed on the company’s website. See this link for more about comparing FreshPet to other dog food brands.

>Freshpet® foods are meat-based products, so you can expect them to have the same moisture content as fresh, human-grade meats. 70-75% moisture is the natural state of fresh meat. Chicken breast meat contains 74.6% moisture, and fresh turkey meat contains 75.8%. (Reference: USDA database) -

The Guaranteed Analysis is used to place a value on four nutrients: protein, fat, fiber, and moisture. However, it doesn’t consider the water content of the product and can be misleading. Even the Food and Drug Administration admits to this problem on its website stating, “To make meaningful comparisons of nutrient levels between a canned (or fresh) and dry product, they should be expressed on the same moisture basis.”

Also see this. Again, your point is totally moot.

The only distinguishing characteristic of the product is that it is refrigerated.

Not true. Freshpet offers fresher and healthier pet food that has been minimally processed. It establishes itself as a premium product offering real meat and vegetables

Capital-intensive, Cash-burning Business with a History of Losses

Since inception, FRPT has generated over $160MM in net losses, and has not produced a single EBITDA positive year over its 8-year track record. Going forward, it’s safe to assume FRPT will continue to generate negative cash flow, and once again rely on its CapEx term loan to finance “growth”

If there was a way to randomly quote financial numbers from its prospectus better, I would be impressed. Everything above is meaningless. Sony reported a $2 billion dolllar loss in its gaming division once. So what? The author seems to believe that factories, fridges and products build themselves automatically and for free. The author seems to believe marketing is free. Does he even know what “investing” means?

EBITDA means, “earnings before interest, taxes, depreciation and amortization.” If a company is reinvesting its revenues, then of course it’s going to be negative.

Adding to the Company’s troubled business model,

What troubled business model? Another scurrilous statement.

FRPT is capital-intensive, with CapEx amounting to over ~$20MM per annum.

So what?

Mixing a negative EBITDA business with capital intensity is asinine, and is the driver behind the Company’s (formerly) levered capital structure, as evidenced by ~$85MM in debt accumulated pre-IPO. FRPT likely could not service the debt load, hence the opportunistic public offering.

Guessing, hypothesize and more guessing. But perhaps the most infuriating sentence is the one I’ve highlighted. This is more than guessing: it’s simple an attack on the company itself. The author is basically accusing the company of being “borderline bankrupt” and “forced to make an IPO to service the debt load.” He even accuses their IPO of being “opportunistic.” Absolutely fucking disgusting. This is a disgrace to every financial analyst in the world and I have no idea why anyone would tolerate this kind of bullshit.

Read the two sentences above again: you could barely make a more manipulative and bullshitting sentence even if you tried. First, the author has no idea whether or not the company was able to service the debt load AT ALL. It’s more than just speculating at this point, it’s outright lying. What is this statement based on? How the hell could they even have an idea? The company had $85M in debt before its IPO, sure, but it’s now valued at over $500M. This is nothing catrastrophic - not even something worrisome. Again, how was the company supposed to finance its growth?

This is the kind of sentence that get me way more agitated than it should because I know some people will take it as fact, while it is nothing but a wild guess and lies. This “researcher” is a liar, a crook and a scammer, end of the line. Compare his statement to mine, for instance: in my original article, I said that FRPT was indeed burning cash fast, which is true. I didn’t write, “FRPT is Satan and burns money in the fires from the pits of hell.” I didn’t write, “FRPT only did its IPO so it would have more cash to waste.”

This is a manipulative and scurrilous article. End of the line. Believe it or not, it gets worse.

Aggressive Accounting and Lack of Disclosure

Freshpet employs aggressive and misleading accounting methods. Such examples include placing outbound freight costs in SG&A versus cost of goods sold (enhancing gross margins)

Gross margin = (revenues - cost to product items) / revenues. That’s the definition of a gross margin. Freshpet didn’t reinvent the wheel here, it’s simply following the norm. Another lie.

and assuming a ~9-year life for fridges (warranty is 3 years),

See how he subtly implies a fridge only lasts 3 years here? As in, “very soon every fridge is going to come crashing down and FRPT will have to spend millions and millions to service them!” What does a 3 year warranty has to do with the expected life of a product? More warranty only cover manufacturing defects anyway. Hell, my fridge had a warranty for one year, and it has been lasting for 10+ years now. A 9-year life for fridges is decent, if not a bit conservative.

among other items detailed within the S-1. Similar to other recent shorts, Freshpet utilizes aggressive EBITDA add-backs, such as marketing expense for its fridges, which mis-portray earnings.

This makes zero sense. I’m not even going to start trying to comprehend this.

FRPT does not disclose common metrics such as same-store sales and unit economics. It is baffling why a newly public company would not want to disclose such metrics, unless it does not “agree” with the story touted to the street.

Of course they won’t! Do you think they are going to tell their competitors, “hey, our sales are growing super fast at this and this location! You guys should come and market more aggressively at those store!” What an utter load of crap!

And cut the manipulative writing. It’s starting to seriously get on my nerves. Stick, with, facts.

Misperceived Growth and Overstated Earnings Power

Freshpet’s consensus growth story is highly flawed. The Company’s target addressable market has been stated at ~35,000. Recall, FRPT has been in many of its competitors’ stores since FY07 (Wal-Mart) to FY12, implying that it has likely already penetrated its addressable market for each chain (i.e. 100% penetration at PETM/Petco). Using aggressive assumptions, FRPT’s addressable store count is ~20,000 stores, which is further supported by the Company’s 6,000 new fridge three-year goal.

This is another bullshit argument. First, if what you were saying was true, Freshpet could be sued for mispresenting its information in its prospectus. Which won’t happen, thankfully, because Freshpet is not misrepresenting its data in its prospectus. Second, yes, it hit a 100% penetration in two chains, but that’s a GOOD thing. I don’t see in what Bizaro world a 100% penetration could be considered a bad thing. Petco loves the product so much it chose to place it into every single one of their stores. How is that turned into something negative?

“Apple is now selling its products in nearly every country in the world! OH NO!”

As for “penetrated its addressable market for each chain,” this is simply not true. Taking data that goes back as far as 2007 - when the first was barely starting - is another deceiving act. What you insinuate here is that Freshpet has been sold in Wal-Mart since 2007 and that, basically, Wal-Mart is never going to put them into any other store ever again. Anyone who even dealt with a large retailer knows this is false.

First, the market varies greatly from a region to another. Wal-Mart is NEVER going to say, “oh, I’m putting your all-new product in every store” right away because the risk would be immense. If the product does not sell, Wal-Mart would lose millions in lost revenues. Instead, what they do is test market it for a few years, then expand, then expand again, then expand again. There’s a few reasons for that: other than distributions, Wal-Mart does not want to become too dependant on a supplier. What if Freshpet had failed in 2010? Then it would be stuck with a product that would vanish overnight.

I’ve detailed this problem clearly in my original article, with the toothpaste example. Do you seriously think you could take your product in Wal-Mart and convince them to put it into every store right away? Of course not. Then, there’s the problem of product. Imagine having to suddenly supply 10,000 stores, let alone with fresh products, within a day’s notice. This would simply be a nightmare and even if Wal-Mart was stupid enough to offer it (it wouldn’t), Freshpet wouldn’t accept, and even if Freshpet accepted, it wouldn’t be able to deliver because we are talking about millions and millions of products that you have to make pretty much overnight.

Ariana Research knows absolutely nothing about how the retailing world works.20,000 stores. Based on your premise, Freshpet would stop growing a year from now! “Hey guys, we’ve been growing at a 50% rate for five years now, but I guess we have to stop because Ariana Research says so, okay?”

It is clear that Freshpet is nearing saturation in its current business.

No, it is not.

FRPT is restricted by how much it can display and store in one refrigerator,

Another empty sentence. EVERY business is restricted by how much it can display in store in their shelf space! What the hell is going on?

“Guys, we run an Apple store, but we are limited by how much we can display and store in a store!”

hence shelf-space expansion would be expensive, as it would require a larger refrigerator or second refrigerator.

That would be true if Freshpet did not restock its products. Oh wait.

Therefore, the more popular the product, the faster FRPT’s SSS will likely plateau.

Yeah, if it couldn’t restock its fridges. You do realize that if customers buy things faster, Freshpet will refill the fridges faster?

The only method to increase productivity would be through increasing sales turns from their current level of ~8x. This is unlikely given the high level of turns and given that sales per sq. ft. are currently $414 versus the supermarket average of $575. Considering this product has been around for over 5 years, further SSS increases are unlikely.

This is so misleading it’s infuriating. You have absolutely NO idea what you are talking about and you are seriously angering me.

You compare Freshpet’s sales per square feet to the supermarket average. Okay, but you forgot PROFITS. Would you rather have $575 in sales at a 5% profit margin (which is higher than many categories supermarket operate in) or $414 at a ten percent profit margin? JUST BECAUSE A PRODUCT SELLS MORE DOESN’T MEAN IT’S MORE PROFITABLE! If I could underline this five times, I would.

Fucking idiot.

FRPT is 100% penetrated in the two largest pet specialty retailers, PetSmart and Petco, ~40% penetrated in Wal-Mart, 64% penetrated in Target and 65% penetrated in Whole Foods Market. Recall that FRPT has been in many of these retailers for over ~3 years, suggesting that the probability of further rollouts within these retailers is unlikely.

Why would it be unlikely? Again, have you ever even worked in retail? “Guys, this product is in 65% of our stores and it’s selling quite well, but there is no way we are adding them into our remaining 35% stores! No way in hell, we hate making profits!” And you do realize, once again, that those superchain open more and more stores, right? It’s not like Wal-Mart is going to sit on its current number of stores and wait.

Assuming FRPT can reach its “pie in the sky” penetration goal of 100%, or 35K stores, this would imply revenues of ~$263MM ($7.5K per refrigerator compared with sub $7K current sales per fridge multiplied by 35,000 units) and EBITDA of ~$85MM.

Earlier, you said Freshpet would only reach an EBITDA of $25-30M and now you claim it could reach $85M. You contradict yourself. Also, why do you assume Freshpet would peak at this very level? “Damn, we reached $85MM in EBITDA, guess we have to stop growing now.”

The probability of this scenario occurring is highly unlikely.

And why would it be?

The funniest part yet

The article then goes on repeating the same fake bullshit using even cuter words, until it eventually comes to the funniest part of this whole article:

You went to one store and took one blurry picture and you call this “onsite due diligence”? SERIOUSLY?

WOW!

Why am I still reading this garbage? I mean, I actually had to sit down and gasp for air after reading this because it was just too much for me. Flabbergasted. I was absolutely flabbergasted. I hope NO ONE takes this article - which was on the front page of SeekingAlpha, a website with millions of visitors - seriously.

Wow.

Dubious financial analysis

The article goes on, and on, and on, exposing specious point after the other, with a particular funny point the author calls “Porter Five Forces Analysis” (hint: four of his five points are, “FRPT is fucked!” and the last one is, “FRPT is slightly fucked”), until you eventually arrive to perhaps the worst financial analysis that has ever been made:

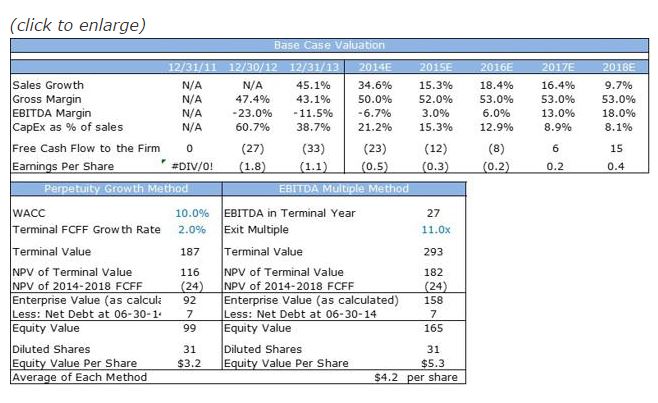

There is so much wrong with this I genuinely feel overwhelmed. Basically, the table above has been designed to look convincing while still being completely wrong. You are supposed to look at this and think, “What are all those numbers! Wow, the share is worth $4.2 on average! It now trades at $17.00, I should definitely sell!”

Aside from the very weird analysis and hiding almost all of his assumptions (this idiot puts the net profit at 2.5% of FCF! And he has the nerve to keep it constant forever!), it’s simply way over-simplistic and supercilious at best. For instance, how does he arrive at a WACC (weighed average cost of capital) of 10%? Why does he assume the firm will be bough out in 2018 at an “exit multiple” of 2011? Why does he see sales growing hardcore in 2015 at 15.3%, nothing less, while the firm just reported a 37% year-over-year growth?

But the biggest problem by far is the “Terminal FCFF Growth Rate” at 2%. I have no idea why he chose such a silly value, it just doesn’t make any sense. I assume he just pulled it out of thin air because it would literally be the slowest-growing company in the universe. And he sees that coming 4 years from now? Absolutely and utterly ridiculous. This is just a laughable analysis and a lie in the face of investors. Even in his “upside” scenario, the author only assumes a 3% free cash flow growth! According to him, Free Cash Flow will grow nearly 100% from 2017 to 2018, then 3% from 2018 to 2019!

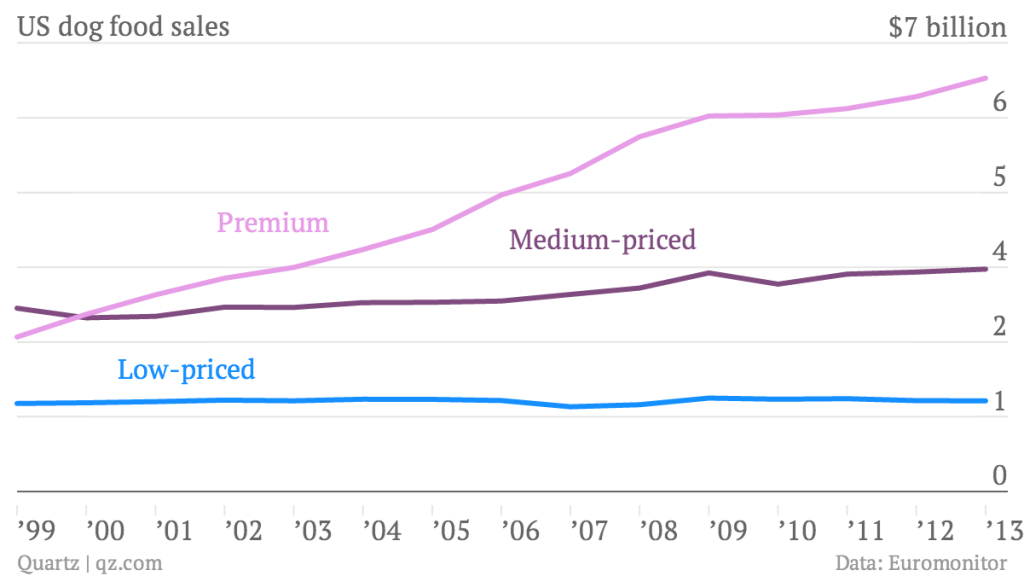

Thew market for dog food - that is, total sales - grows at 5% per year. Keep in mind there is inflation in some of that, so growing faster than the average 1-2% inflation we’ve had in the last few years. Population is growing and so is the number of dogs. There is no way, not even one in a million, that Freshpet, being in the premium space of pet food, would grow at only 2% per year 4 years from now. It’s just a farce. Overall, the author chose extremelycatastrophic assumptions to justify his stupid analysis.

His last post is perhaps the most offensive:

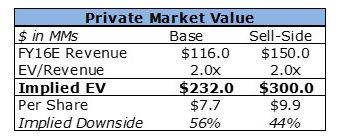

What the author says here is that he is clearly better than all those hedge funds and firms that financed the deal at $15 per share. Remember: some very large funds invested several millions into Freshpet at a price of $15M per share, and then bought even more using their greenshoe options. He’s basically saying that those firms with hundreds and hundreds of qualified analysts and professionals (who are still locked in and unable to sell) are idiots who wasted their money by basically buying the company for twice what it was worth. Wow.

The idea you’re supposed to get from the picture above is that “wow, in the best case scenario, Freshpet will still crash 44%!” This is completely idiotic.

Verdict:

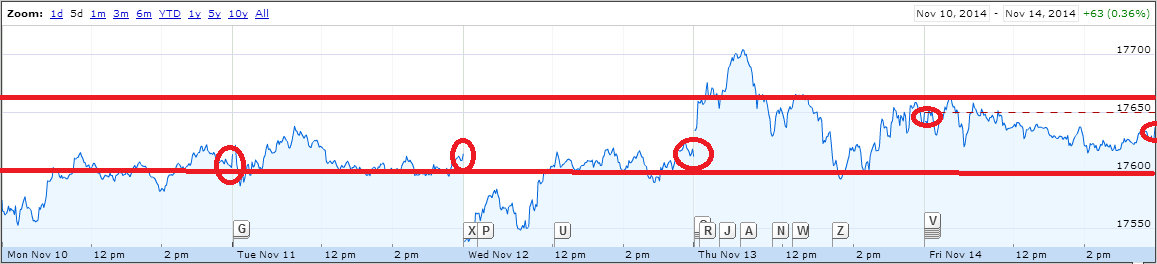

This article is a textbook “bullshit” analysis meant to look serious, but extremely superficial in nature. Its manipulative writing and incompetent financial analysis barely attempt hide a shallow and devious agenda to crash the stock price. It is rather clear the author is short on the company and attempting to drive the stock down and the worst is that I’ve seen this kind of tactic work in the past. Yes, an “analysis” from a so-called expert can indeed crash a company because it creates a snowballing effect and a self-fulfilling prophecy.

“Someone wrote a very pessimistic analysis? I better sell my stock now!”

“The stock is crashing? I suppose the report was right. I better sell as well!”

“Wow, the stock is plummeting! This must be due to that report which exposed a ‘hidden truth.’ Sell, sell, sell!”

This kind of market manipulation should be plain and simply illegal, if it isn’t already (pump and dump, or crash and buys, are rarely investigated, yet alone prosecuted, and even more rarely convicted). Spreading lies, attempting to manipulate the market with outright false statement and going into crazy impossible scenarios to attack a company is a vile act by a vile person hidden under the cover of anonymity. Overall, this article was written as a kind of gamble: in the unlikely scenario Freshpet crashes due to some untold problem, the author will look like a genius and gain readers, albeit in the cheapest of manners.

To be clear, there is in fact a massive bear case to be made about Freshpet, but the author doesn’t even come close to making such a case. His long-winded and artfully crafted text manages to be convincing enough that some people will seriously consider selling their shares or shorting, even though his thesis is nothing but hot air.

About Freshpet

Freshpet is not the IPO of the year (Alibaba easily takes that sport) and it does face major risks. The one that worries me the most is that even if the company does very well (which I think it will), the stock may still crash. Expectations are high, volatility is extreme (a problem exacerbated by the IPO and when the lockup period ends) and is going to hit hard at any occasion. Overall, there are simplybetter IPOs right now to be in (LendingClub, for instance).

Still, Freshpet is a great company with several lasting advantages, excellent products and competent managers who so far have had almost a perfect run. I’m holding my shares

Read from my original article:

For instance, in three years, it should reach $250 millions in sales easily and if it can somehow maintain its high margin (which I believe it will), we will have a company worth close to a billion on our hands.

Using its most recent results (37% growth year over year), this figure does seem a little bit high in the time frame I originally exposed , but I still believe it can reach $200-$225 in sales (($64M in 2013, increasing by 37% per year for four years) within three years - and keep growing after that. I still believe this company could give a 100% return (one billion valuation based on a 50% gross margin, $250M in sales and a 8x gross revenues multiple) within 3-4 years.

Also consider this:

One opportunity is to sell more of its food to cat lovers. Thompson said about 90% of the company’s products are consumed by dogs, with the rest sold to cats. But Americans own more cats than dogs: 95.6 million versus 83.3 million, according to 2012 estimates by the American Pet Products Association.

And:

As well as:

Thompson said Freshpet is beloved by retailers, as its items are meant to be consumed within roughly 10 days of first use, and thus inspire repeat visits to stores.

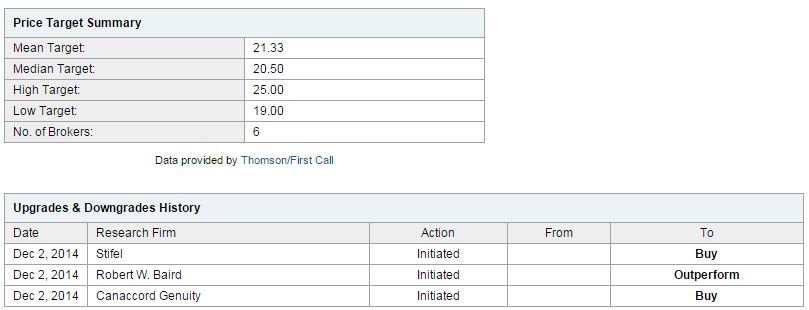

Finally, consider what analysts have to say about Freshpet:

Conclusion: drop that nonsensical “analysis” in the garbage bin where it belongs, it’s utterly worthless. Give absolutely no credibility to anything Ariana Research writes. These guys are crooks attempting to manipulate the market and drop the share price so they could profit. I would have at least a shred of respect had Ariana Research posted his analysis at least 3 days before shorting, which he of course didn’t do (he shorted, then published to attempt to drive the stock down). Absolutely disgusting, and someone had to say it.